After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Amazon Prime: one subscription to rule them all?

Rob Gallagher, director, media and entertainment research and analysis at Ovum, reflects on the role of video within Amazon Prime and how it affects Amazon’s wider business model.

In 2016, Amazon CEO Jeff Bezos said of the company’s Prime service: “We get to monetise video in a very unusual way. When we win a Golden Globe, it helps us sell more shoes.” In the coming years, the strategy will go well beyond simple shopping to transforming TV.

To explain Bezos’ quip: Amazon Prime launched in 2005 with the promise of free shipping for a flat subscription fee, adding all-you-can-eat access to thousands of movies and TV shows a year later. The logic? Video would attract more subscribers and subscribers would shop more on Amazon.

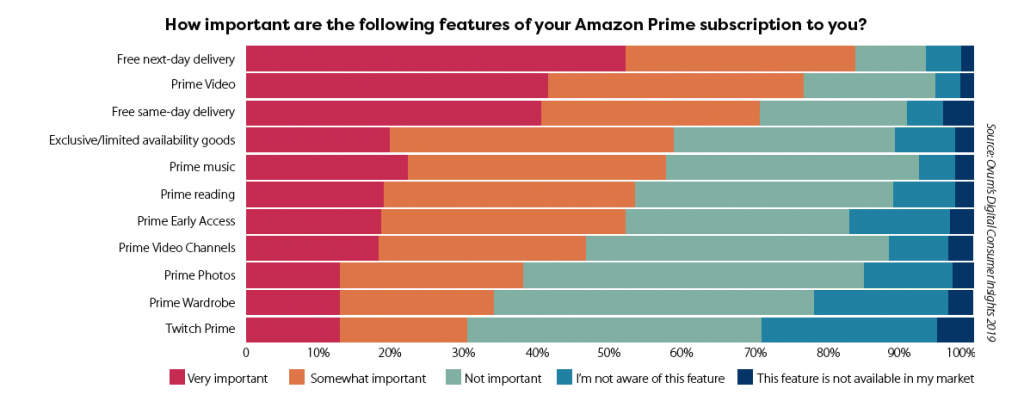

Ovum’s latest Digital Consumer Insights survey sheds light on the current and future success of the strategy:

• Two out of five US and UK households subscribe to Prime. In the US and UK, 48% and 41% of 16-plus internet users said they have access to Prime, respectively, equal to around 40% of households in each country.

• Commerce is king for Prime customers – but only just: 77% of US and UK Prime subscribers rated Prime Video as “very important” (42%) or “somewhat important” (35%) – second only to free next-day delivery (84%), and ahead of same-day delivery (71%).

• Video still has the potential to win over Prime holdouts. A third (31%) of non-subscribers identified “I use other streaming video services” as why they hadn’t signed up, ahead of various commerce-related reasons. This suggests that more appealing exclusive TV shows and movies could change their minds.

• Content will be key to cracking new markets. Video was the service most respondents in both Prime and non-Prime countries said they would like to see in a subscription bundle of content and commerce (67%), ahead of free deliveries and returns (53%). The success of Prime will provide a platform for Amazon to play multiple roles in tomorrow’s TV and video market:

• One of the “subscription-video six.” Just six companies will serve over half of the one billion online video subscriptions in use in 2023, according to Ovum’s forecasts. The power of Prime will ensure Amazon will be in second place with nearly 130 million active video subscribers, behind Netflix, but ahead of Disney, Apple, AT&T, and Google.

• A key moderniser of TV advertising. Amazon’s new movie service, IMDB TV, will likely prove its least significant foray into ad-funded video. More important will be moves to build a digital advertising ecosystem that harnesses the company’s considerable premium video, smart-TV device, commerce, and AI assets to challenge Google and Facebook, including in video advertising, worth US$88 billion (€79.5 billion) in 2023.

• An iTunes killer – and Apple TV inhibitor. Apple’s digital rental and download-to-own service had more than one assassin, not least Netflix. But with US$11.9 billion (€10.8 billion) in revenue in 2023, the transactional video on demand (TVOD) market will remain large and growing, and Amazon will keep chipping away at Apple’s share, even under its new incarnation as Apple TV.

• A leading TV and video “super-aggregator.” Tim Cook claims Apple TV’s interface is “unmatched,” but Amazon was the first to bring together all kinds of online TV and video with Fire TV. The spread of Fire to smart TV sets – most people’s preferred device for watching premium video – will strengthen the platform’s appeal as one of the handful of places future viewers will go to discover and watch TV.

Amazon’s growing power comes as ‘big media’ – Disney, WarnerMedia, Comcast, and Viacom – prepares to fight back against ‘big tech’, Netflix in particular. But the retail giant seems less an enemy than a ‘frenemy’, offering media companies multiple ways to reach consumers and monetise content, from re-selling app subscriptions to TVOD to advertising. And it will always have a play even its largest rival companies would struggle to disrupt: free shipping.

For more information on Ovum research, contact [email protected].