After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

European audiovisual revenues becoming more concentrated as SVOD drives growth

The top 100 audiovisual players in the European market are growing twice as fast as the market overall, according to the latest report by the European Audiovisual Observatory.

According to the Top Players in the European Audiovisual Industry – Ownership and Concentration report, the cumulative service operating revenues of the top 100 audiovisual companies in Europe grew between 2016 and 2021 twice as fast as the overall market and at a higher pace than that of average inflation.

According to the Top Players in the European Audiovisual Industry – Ownership and Concentration report, the cumulative service operating revenues of the top 100 audiovisual companies in Europe grew between 2016 and 2021 twice as fast as the overall market and at a higher pace than that of average inflation.

The report found that the top 100 companies grew by 17% in 2021 when compared to 2016. The positive trend of the overall audiovisual service market was due to primarily to the SVOD market. However, the cumulative revenues of primarily traditional players in broadcasting and pay TV among the top 100 also increased in 2021 by 10% over 2016.

Traditional players brought in 56% of the incremental revenues delivered by the top 100 groups over the same period. However, the growth of the top 100 players was largely driven by the pure SVOD players, namely Netflix, Amazon, DAZN and Apple. Their cumulated revenues grew by a factor of 6 between 2016 and 2021 and accounted for 44% of the growth of the top 100 players, said the report.

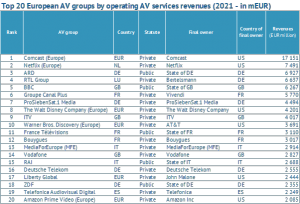

The top 20 players consistently represented 71% of the top 100 revenue figures over the same period analysed. Public broadcasters performed less well and in 2021 saw their weight diminish by 3% compared with 2016, and their market share drop to 30% in 2021.

The weight of US companies in the top 100 revenues increased in 2021 by 3% over 2016, giving them a 30% market share at the end of 2021. This was mainly due to the rise of the pure SVOD players but also of the SVOD services of US-backed broadcasters such as Sky, Paramount+ and Disney+.

SVOD revenues are more highly concentrated than those of pay TV, with Netflix, Amazon and Disney+ accounting for 71% of SVOD revenues in Europe in 2021, while the top 20 pay TV players accounted for 76% of revenues in that market.

The top earning companies in Europe were Comcast with 2021 revenues of €17 billion, followed by Netflix with €7.5 billion and German pubcaster ARD with €6.9 billion. RTL came fourth with €6.6 billion, followed by the UK’s BBC with €6.3 billion.