After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Omdia: 60% of Netflix subs will be on ad-supported tier

Three out of five Netflix subscribers will be on the streamer’s ad-supported tier by 2027, according to research outfit Omdia.

Three out of five Netflix subscribers will be on the streamer’s ad-supported tier by 2027, according to research outfit Omdia.

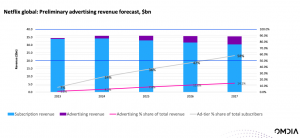

Omdia estimates that by that date nearly 60% of global Netflix subscribers will be on the ad-supported tier. This change will happen through a combination of new subscriber acquisition and downgrading of existing subscribers to the ad-tier, according to DTVE’s sister research group.

Omdia Senior Research Director, Maria Rua Aguete said: “Netflix is expected to generate just under a quarter of its revenue from advertising by 2027 in the US. With growth in SVOD expected to increase from $86 billion in 2022 to $118 billion in 2027, it comes as no surprise that all the major SVOD services including Netflix want to take part in that growth.”

In the next five years, online advertising revenues will almost double from US$190 billion in 2022 to US$362 billion in 2027 according to Omdia.

In the next five years, online advertising revenues will almost double from US$190 billion in 2022 to US$362 billion in 2027 according to Omdia.

At a presentation at the Iberseries event in Spain, Rua Aguete said that Omdia expects online video subscriptions to grow to two billion globally by 2027, far outpacing pay TV. However, online video advertising will generate three times the revenue of SVOD by that date.

In the US, online video advertising will be generating 10-year CAGR of 19.9% by 2026, compared with 18% for online video and only 0.6% for pay TV, according to Omdia.

Ad load and ad formats are major tactical considerations in implementing hybrid models. Omdia expects Netflix to cap instream video ad loads and refrain from introducing ads in the user interface to maintain the premium consumer experience, particularly internationally, where hybrid models are not fully established.

The research group cited reports that Netflix intends to keep the ad load below four minutes per hour. This would be on a par with rival streamer HBO Max’s ad load cap, but below all other hybrid streamers in the US.

In the US, Omdia expects Netflix’s ARPU from its hybrid ad-supported tier to be roughly equal to the consumer price of its premium tier despite the ad load capping.

However, the research group acknlowedges that this will be a lot more challenging in less mature international markets with lower CPMs and a smaller pool of premium potential connected TV advertisers.

While Omdia expects that Netflix will generate 23% of its overall US revenue from instream advertising in 2027, globally, this figure will be significantly lower at 14%.

Although advertising will not displace subscription as the main source of Netflix revenue, the impact of Netflix’s foray into advertising on the wider competitive landscape should not be underestimated, says Omdia.

The research outfit said it expects Netflix to become a formidable connected TV ad market player in the US, fully competitive with other prominent hybrid D2C offerings, such as Hulu, Peacock and Paramount+.