After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

OTT operators to increase sports spend in 2022

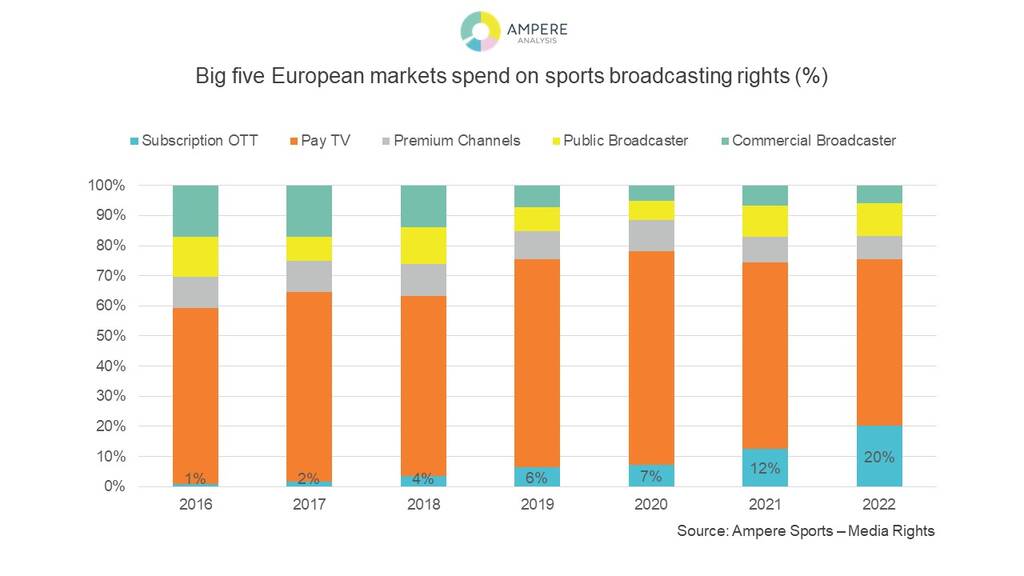

OTT platforms are expected to account for 20% of all sports rights spend in 2022.

OTT platforms are expected to account for 20% of all sports rights spend in 2022.

According to a new report from Ampere Analysis across the big five European markets – UK, Italy, Germany, France, and Spain – OTT platform operators will increase their spend on sports rights this year.

Italy is the largest market for OTT platforms in sport, with more than half of spending set to come from OTT in 2022 thanks to the dominance of DAZN, which holds the domestic rights to Italy’s Serie A.

In total, 53% of Italy’s sports spending will be generated by subscription OTT services by the end of the year. This is followed by Germany (32%), Spain (16%), and France (14%).

The UK is the outlier, with traditional linear TV broadcasters Sky Sports and BT Sport having a stranglehold over rights. Only 2% of the spend on sports TV rights in the country is from streaming subscriptions.

Despite this its underrepresented contribution to OTT spend, the UK is the second highest of the five mentioned markets in terms of sports fans having access to at least one OTT service showing sports. Some 58% of Brits have access to at least one subscription platform that broadcasts sports, with Amazon Prime Video being the most popular.

The report also notes that, across the five markets, DAZN is the third-largest spender on sports rights, having overtaken BT in 2021. Sky and Telefónica are first and second respectively, while Amazon is in 10th.

The UK-based DAZN is expected to spend €2.1 billion on sports rights in 2022 globally, with Italy, Germany, and Spain being its largest markets for sports spend. Sky Meanwhile will spend €4 billion on sports rights, representing around a third of the total across the five markets.

The UK-based DAZN is expected to spend €2.1 billion on sports rights in 2022 globally, with Italy, Germany, and Spain being its largest markets for sports spend. Sky Meanwhile will spend €4 billion on sports rights, representing around a third of the total across the five markets.

Ben McMurray, analyst at Ampere Analysis said: “In the most developed markets, fixed-line broadband is approaching ubiquity and subscription OTT is already in as many households as Pay TV, so internet access is no longer a limiting factor.

“However, streaming services nonetheless need to solve business model challenges before they can seriously rival incumbent pay TV groups. Sustaining the current level of investment in sports rights without the benefit of the economics of bundling will be one of the key issues for subscription OTT players entering the sports rights market.”