After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Futuresource: Netflix driving SVOD in France, but multi-subscriptions lag

Netflix is driving growth of subscription video-on-demand in France, but multiple SVOD subscriptions, which have yet to take off, are expected to grow with the launch of new entrants over the next couple of years, according to Futuresource Consulting.

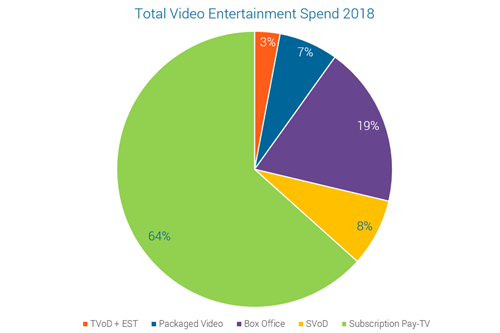

According to the research outfit, total video entertainment consumer spend in France is expected to exceed €7 billion this year, making France the third largest video entertainment market in Europe. Pay TV accounts for 64% of that but, despite the closure of CanalPlay, SVOD has started to gain traction, with SVOD revenues expected to pass €827 million this year. Netflix is the dominant player, with five million subscribers at the end of last year, accounting for half the market.

According to the research outfit, total video entertainment consumer spend in France is expected to exceed €7 billion this year, making France the third largest video entertainment market in Europe. Pay TV accounts for 64% of that but, despite the closure of CanalPlay, SVOD has started to gain traction, with SVOD revenues expected to pass €827 million this year. Netflix is the dominant player, with five million subscribers at the end of last year, accounting for half the market.

Only 40% of SVOD subscribers currently take more than one service. The demise of Canalplay means that Netflix lacks a serious local competitor.

“Despite the closure of CanalPlay, SVoD has started to take off in France driven by Netflix’s fantastic performance. They have acquired the rights to key local language shows, which have been well received and have created a buzz around the service. From 5 million subscribers at the end of 2018, representing half the market, we are expecting their subscriber base to grow further in 2019,” said Tristan Veale, market analyst at Futuresource Consulting.

“Over two thirds of Netflix users now say viewing on any TV is their most preferred way, with Smart TV’s in particular a key driver, a trend we are seeing in many other markets we survey.”

Futuresource’s analysis of the French video market follows a similar exercise on Italy, where it found that SVOD was growing strongly from a lower base, with a 65% uplift in revenues to €231 million last year.

Futuresource found that pay TV remains dominant within video spend among consumers, but falling subscriptions meant that the value of the market declined by 2% last year to €2.78 billion. The analyst outfit expects subscriptions to fall by a further 7% this year following Mediaset’s exit from premium TV.

“Netflix is a key driver of revenue, although TIMVision had more subscribers thanks to frequent bundling with broadband. In 2019, consumers are expected to spend €340 million on SVoD, up by 47%, with 5.3 million households subscribing to one or more services,” said Veale.