After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

MENA set for big SVOD growth

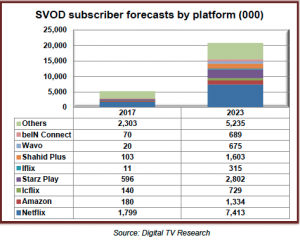

The Middle East and North Africa region – including Turkey – will have 20.8 million subscription video-on-demand subscribers by 2023,up from 5.22 million at the end of last year, according to Digital TV Research.

According to the research outfit’s Middle East and North Africa OTT TV & Video Forecasts report, Turkey will remain the market leader by some distances, with 6.72 million SVOD subscribers, or about a third of the total.

According to the research outfit’s Middle East and North Africa OTT TV & Video Forecasts report, Turkey will remain the market leader by some distances, with 6.72 million SVOD subscribers, or about a third of the total.

Netflix will remain the dominant service across the region as a whole, with 3.57 million subscribers across MENA’s Arabic-speaking countries and 7.41 million across the region as a whole by 2023, according to Digital TV Research.

The top eight multinational platforms – Netflix, Amazon Prime Video, Icflix, Starz Play, Iflix, Wavo, beIN Connect and Shahid Plus – will account for three-quarters of the region’s SVOD subscribers by end-2023, up from 56% in 2017. Leaving Israel and Turkey out, these eight platforms will retain 91% of SVOD subscribers.

SVOD revenue from the region are expected to grow sixfold by 2023 to US$2.03 billion (€1.74 billion).

Market leader Turkey will add US$451 million to more than double its total to $603 million by 2023. Saudi Arabia will increase its SVOD revenues by a factor of seven to reach US$351 million in 2023 to take second place.

“Netflix is dominant across the MENA region. This is partly because it operates in more territories than its Arabic competitors – it has significant subs bases in Israel and Turkey. However, its success is down to more than geographic reach. The global appeal of its original content has spread throughout the region,” said principal analyst Simon Murray.

“Although overall subscriber numbers will climb impressively, there are just too many Arabic platforms. They do not offer enough original or exclusive content to seriously challenge Netflix. We do not believe that the market can sustain this many Arabic platforms in the long run. Our report only covers paying SVOD subscribers – not those receiving free platforms as part of their pay TV subscription.”