After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Pay TV subscriber numbers to rise, revenues to fall in Western Europe

Western European pay TV subscriber numbers will increase by 2.6% between 2017 and 2023, though revenues will fall by roughly 7.2%, according to a new study by Digital TV Research.

The Western Europe Pay TV Forecasts report claims that the pay TV subscriber numbers will climb by three million to reach 106 million in 2023 – with much of the growth coming from countries with traditionally low pay TV penetration.

The Western Europe Pay TV Forecasts report claims that the pay TV subscriber numbers will climb by three million to reach 106 million in 2023 – with much of the growth coming from countries with traditionally low pay TV penetration.

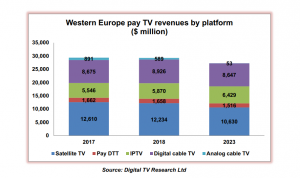

However, over the forecast period, pay TV revenues are expected to fall by US$2.11 billion to reach US$27.27 billion in 2023, with revenues expected to fall in all but three of the 18 countries covered by the report.

The UK pay TV market is expected to lose US$628 million in revenues over this period, although it will remain the most lucrative pay TV market by 2023. Italy is tipped to overtake the Germany market in terms of pay TV revenues in 2023.

“Satellite TV will remain the highest-earning pay TV platform, but its revenues will fall every year from 2011 and will decline by US$2 billion between 2017 and 2023,” according to the report.

The research said that cable TV revenues peaked in 2010 and will lose US$866 million between 2017 and 2023. However, IPTV revenues are expected to climb by 16% between 2017-2023 to US$6.43 billion.

In terms of subscriber additions, more than half of the region’s additions are expected to come from Italy. Subscriber numbers are expected to grow here by 960,000 between 2017 and 2023.

Over the same time period Spain is expected to add 716,000 pay TV subscribers and Germany 913,000 subscribers.

“Subscriber numbers will fall for six of the 18 countries covered in the report,” said Digital TV Research principal analyst, Simon Murray. “The UK will be the worst affected, although it will only lose 234,000 subs between 2017 and 2023.”

Western Europe’s top three operators are expected to account for 39% of the region’s pay TV subscribers by 2023 – and take 50% of pay TV revenues.

The report said that while Liberty Global has been the largest international pay TV operator in Europe for some time, Sky is closing the gap.

By 2023, Liberty Global is expected to have 17.89 million subscribers, compared to 14.86 million for Sky. Third-placed Vodafone is tipped to have 8.85 million subscribers.