After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

IHS: number of EU cable homes reached 65.1m last year

The number of cable homes in Europe grew year-on-year in 2016 and accounted for 30.5% of total television households, according to IHS Markit.

The research firm’s latest European Broadband Cable Yearbook noted that the number of unique cable homes in the EU “continued to climb steadily”, reaching 65.1 million in 2016.

The research firm’s latest European Broadband Cable Yearbook noted that the number of unique cable homes in the EU “continued to climb steadily”, reaching 65.1 million in 2016.

This was up from 64.0 million in 2014 and 64.1 million in 2015, but down slightly compared to the 2010 figure, following declines in both 2011 and 2012.

Germany remained the largest EU market with 18.6 million subcribers – more than three times the number of unique subcribers in the next biggest markets of Romania, the UK and Poland.

“European cable operators are focused on providing the best services to their customers in what is an increasingly competitive marketplace,” said Maria Rua Aguete, executive director for media, service providers and platforms at IHS Markit.

“Investments in network upgrades and advanced platforms have already delivered in terms of ARPU and revenue increases, and are set to do so again in the coming years.”

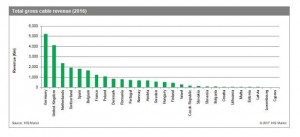

Annual total cable revenue has held steady growth since the beginning of the forecast period in 2010, reaching €23.5 billion last year – up 4% compared to 2015.

Last year average monthly revenue per subscriber was €16.15 for television, €18.99 for internet and €14.67 for telephony. This followed steady annual increases for TV and interent and declines for telephony.

In terms of overall revenue contribution by service, internet’s proportion of revenue continued to rise as TV’s revenue share declined, “reflecting trends in consumer behavior.”

Last year TV accounted for 45.9% of total revenue, internet for 33.7% of revenue and telephony for 20.5%.

On the merger and acquisitions front, the European cable industry saw a number of deals in 2016, including: Telenet’s €400 million bid for Altice’s SFR Belux; Com Hem’s €144 million acquisition of pay DTT operator Boxer; and Liberty Global’s UPC Polska’s agreement to buy Multimedia Polska for approximately €700 million.

“There’s plenty of room for further consolidation in cable, especially in fragmented markets in Central and Eastern Europe,” said Rua Aguete.