After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

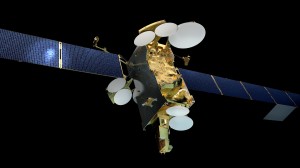

FSS satellite industry struggling to find new growth opportunities

The global fixed satellite services industry generated revenues of US$12.2 billion (€9.13 billion) last year, representing modest growth of 2%, with the majority of operators experiencing a slowdown, according to research by Euroconsult.

According to the research group, 60% of revenue-generating FSS operators experienced a slowdown in 2013 compared with the prior year. Ten operators posted a revenue decrease, compared with only six in 2012.

Lack of opportunities for growth by mergers and acquisitions is leading operators to forge alliances and sharing of orbital resources to further organic growth, according to Euroconsult. While there is a high degree of concentration at the top, with the market dominated by a few major players, the satellite business is seeing increasing fragmentation at the bottom, with a number of national governments sponoring projects to launc satellites. Three operators – Mexsat, Boliviasat and O3b – are expected to report their first FSS revenues this year, while 12 operators are expected to launch their first satellites within the next four years. Operators are also investing in high-throughput satellite payloads, enabling them to offer high-speed data services.

According to Euroconsult, 32,500 TV channels and 146 DTH pay TV platforms were broadcast by satellite operators in 2013.

“In order to re-energize revenue growth, satellite operators are increasingly exploring new revenue streams; in recent years the focus has primarily been on launching new satellites over emerging markets and investments in HTS systems or payloads,” said Nathan de Ruiter, senior consultant at Euroconsult and editor of the report.

“Eleven FSS operators offered HTS capacity to the market in 2013, while nine operators will launch their first HTS satellite or payload within the next four years. Further, we have seen a growing number of regional operators such as ABS, APT Satellite, Arabsat, RSCC and Gazprom Satellite Systems with international expansion plans by launching new satellites outside of their region of origin.”